About

Table of Contents >>Introduction

The OpenMAMA Project is an open source project hosted under the auspices of the Linux Foundation. It is developed and designed using a collaborative effort by an open community of professionals and volunteers – collectively known as contributors. Contributors include anyone that is positively contributing to the OpenMAMA Project.

Contact

For general support, rookie questions and bug reports, check out the Support page. However if you want to get in contact with the OpenMAMA project coordinator for commercial or strategic reasons, please use our contact email address contact@openmama.org.

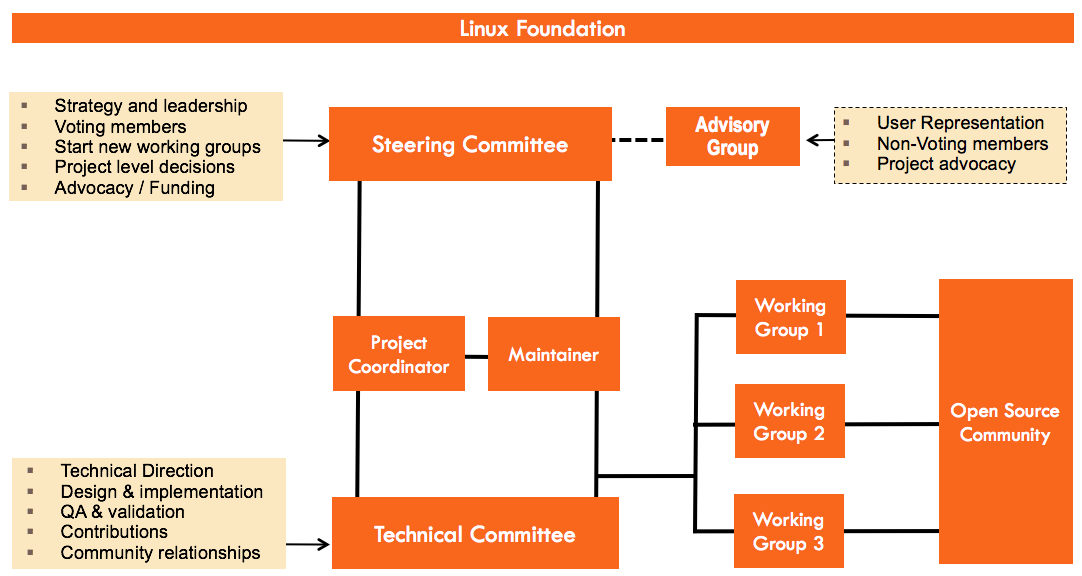

Governance

The short presentation below outlines the Governance structure of OpenMAMA:

OpenMAMA Governance from OpenMAMA

Joining the Steering Committee

To join the OpenMAMA Steering Committee, organizations must sign the OpenMAMA Steering Committee Application which may be requested by emailing contact@openmama.org, and join the Linux Foundation as a member.

Companies represented on the Steering Committee commit to:

- Steering the project to advance its market and technical success

- Participating in the Interest Groups

- Disclosing their status as a member of the OpenMAMA project

- Becoming a member of the Linux Foundation, host of the project

- Being a good citizen of the project

Role of the Steering Committee

- Provide guidance, input on strategy and drive the longer term vision and roadmap

- Advocate OpenMAMA to advance its market and technical success

- Work in collaboration with other members and resource working Groups

- Disclose their status as a member of the OpenMAMA project

- Become a member of the Linux Foundation, host of the project

Steering Committee Coordinator

Elected by Steering Committee for a period of 1 year

This is not a ceremonial role. The Coordinator is expected to devote adequate time and energy to make the project successful.

- Driving Steering Committee activities, agenda, calls, action items, planning, follow-ups, etc.

- Interfacing between Steering and Technical Groups and interest groups

- Pursue various commercial and strategic initiatives as they present themselves

Advisory Group

The Advisory Group is an informal derivative of the OpenMAMA Steering Committee, it is intended to lower the barrier to entry for users and financial institutions who can make a meaningful contribution to the direction and success of the OpenMAMA project but are not presently official Steering Committee members.

- Provide guidance, input on strategy and roadmap

- Work in collaboration with other participants

- Limited access to the select committee meetings and advisory group meetings

- Forum for users to advocate on roadmap and project direction but no voting rights or direct influence

Role of the Technical Group and Working Groups

- Software architecture and implementation activities

- Software testing and validation

- Developing compliance test suites

- Removing any technical inhibitors facing adoption of OpenMAMA

- Reviewing submitted requests for new features, capabilities, prioritizing them, aligning them with decided implementation roadmap

- Defining compliance profile and implementation verification test suites for 3rd party OpenMAMA-based stacks

- Release plan and roadmap

- Working with other open source projects on which OpenMAMA supported applications and solutions depend

Role of the OpenMAMA Software Maintainer

As in most open source projects, OpenMAMA will have a dedicated source code maintainer who, as the delegated authority, reviews changes that are submitted by contributors, provides feedback to the developers, and accepts community contributions where appropriate.

Responsibilities of the OpenMAMA Software Maintainer include:

- Approve and develop roadmap based on suggestions from the Steering Committee

- Work with the technical team to drive the technical direction of the OpenMAMA project

- Scheduling work efforts based on prioritization of the Steering Committee and the needs of the project

- Managing resources and their work items

- Setting the criteria for accepted / rejected code

- Reviewing submitted code / accept and reject based on pre-defined rules

- Tracking dependency issues

- Notifying developers of source code changes that may affect their packages

- Managing source code security issues

- Working closely with technical team developing the source code

- Working closely with QA team testing the source code

- Dealing with reported bugs in a timely manner

- Preparing binaries - packages of the source code

OpenMAMA Working Groups

These ad hoc groups define and document the various requirements for the OpenMAMA Project, which are formed around the strongest needs for the Project’s users. The Technical Group take these requirements and work with the Maintainer to develop plans for execution.

OpenMAMA Supporter

There is also the concept of an OpenMAMA supporter, this is a firm who supports / has adopted OpenMAMA in their products or services and may or may not contribute to the community collaborative projects.

OpenMAMA Steering Committee Members

Vela

Vela is a leading independent provider of trading and market access technology for global multi-asset electronic trading. Our software enables clients to successfully execute on their trading strategies and manage risk across multiple fragmented markets, liquidity pools, and data sources. We help firms successfully differentiate and innovate in an ever-changing, increasingly-regulated and fiercely-competitive landscape, while also reducing total cost of ownership.

Vela’s ticker plant, execution gateways, trading platform, and risk and analytics software deliver a unique, ultra-low latency technology stack for electronic low-touch and Direct Market Access (DMA) execution and pricing. We leverage the latest innovations in technology to deliver cutting-edge performance, features and reliability. Our modular stack is accessed through a single set of trading, data and risk APIs and can be delivered as-a-Service from multiple co-location data centers globally.

With access to more than 200 venues, Vela provides global coverage across all major asset classes. Clients are supported by an award-winning team of technical and business experts available 24x7 from our multiple offices in the US, Europe, and Asia. Vela’s clients include traders, market makers, brokers, banks, investment firms, exchanges, and other market participants.

Visit us at http://www.tradevela.com. Follow us on Twitter @TradeVela.

J.P. Morgan

J.P. Morgan is a leader in financial services, offering solutions to clients in more than 100 countries with one of the most comprehensive global product platforms available. We have been helping our clients to do business and manage their wealth for more than 200 years. Our business has been built upon our core principle of putting our clients’ interests first.

J.P. Morgan is part of JPMorgan Chase & Co. (NYSE: JPM), a global financial services firm with assets of $2.3 trillion.

Deutsche Bank

Deutsche Bank provides commercial and investment banking, retail banking, transaction banking and asset and wealth management products and services to corporations, governments, institutional investors, small and medium-sized businesses, and private individuals.

Deutsche Bank is Germany’s leading bank, with a strong position in Europe and a significant presence in the Americas and Asia Pacific.

Tick42

Tick42 is the latest name for DOT (Dealing Object Technology), we have changed our name in recognition of the fact that our products are no longer just for dealing, and also to allow us to integrate our Bulgarian development team.

Tick42 has long experience of working with market data and trading systems in both Linux and Windows, providing developers with the knowledge and precision technology they need.

As well as creating our own products, our work for major companies has included delivering the original Reuters Triarch Workstation, working on the first handlers for Bloomberg’s BPIPE feeds, and developing EasyScreen’s Futures and Options trading system.

Tick42 also brings its expertise in real-time, mission-critical trading applications to delivering project work for our clients. Our team has extensive experience of Java, Excel, .Net, C++ and Streambase, together with a deep understanding of what’s required to deliver and support projects and products in modern trading environments.

Solace

Solace helps large enterprises become modern and real-time by giving them everything they need to make their business operations and customer interactions event-driven. With PubSub+, the market’s first and only event management platform, the company provides a comprehensive way to create, document, discover and stream events from where they are produced to where they need to be consumed – securely, reliably, quickly, and guaranteed. Enterprises use Solace’s advanced event broker technologies to modernize legacy applications, deploy modern microservices, and build an event mesh to support their hybrid cloud, multi-cloud and IoT architectures. Learn more at solace.com.

Arcontech

Arcontech software enables the collection, aggregation, manipulation, redistribution and presentation of market data in real-time from multiple sources and to multiple destinations. Interoperable with all commonly used platforms and venues, and with our own API’s for unlimited additional development, Arcontech solutions have full authentication and entitlements capabilities to be fully compliant.

Our clients include Central, as well as major Tier1 and Tier2 banks, for whom we provide robust, efficient and cost effective solutions which integrate with or have replaced incumbent platforms, as well as our own caches and transformation engines, bridges, feed-handlers, excel add-in and display applications.

Supporting Organizations

In addition to the participation of the OpenMAMA Steering Committee, the following companies have pledged to support OpenMAMA in their products and services.

To become an official supporting organization of the OpenMAMA project and see your logo here please contact info@openmama.org.

Actant

Actant is a leading trading solutions provider specialising in market making and algorithmic trading with offices in London, Zug, Chicago and New York. Actant is a pioneer in the design and creation of high performance, functionally rich, programmable, multi-asset electronic trading software.

For more information, please visit www.actant.com.

ACTIV

ACTIV is a global provider of real-time, multi-asset financial market data and solutions. ACTIV offers neutral, managed services for buy and sell-side firms and technology providers seeking a complete market data solution that encompasses both global content management and data delivery. With coverage spanning more than 150 equity and derivatives exchanges around the world, ACTIV is the only truly end-to-end, independent market data utility in the industry. Founded in 2002 by market data specialists, the firm is privately owned and has offices in Chicago, New York, Tokyo, Singapore and London.\

Fixnetix

Fixnetix provides outsourced services for ultra-low latency trading, market data, hosting and infrastructure connectivity as well as risk management solutions to leading global banks, hedge funds and proprietary trading groups.\

ITRS Group

ITRS Group leads the way in providing a comprehensive operational and service software management solution. Trading infrastructures in today’s financial institutions are becoming too complex and interconnected to be successfully managed via multiple tools and adding ever more people. ITRS solves this dilemma.\

MDX Technology

MDX Technology is a vendor independent and innovative software development company delivering high performance, flexible, user friendly and cost effective solutions for the trading room environment.

We offer vendor agnostic real-time market data connectivity solutions, data sharing solutions and consultancy. Our solutions are deployed in prop traders, hedge funds, spread betters, tier 1 IBs and IDBs in the US, EMEA and APAC. Typically our technology is being used to achieve: cost saving through development acceleration and rationalisation of legacy apps and; performance improvements.\

MetaFluent

MetaFluent software makes market data adapt to your business rather than the other way around. Whether it’s our lightweight, high-performance Excel add-in for real-time data or our software that transforms data and symbology from multiple vendors, MetaFluent gives you the agility that your business demands. For more information, please visit our website at www.metafluent.com.

OneMarketData

Today, OneMarketData delivers comprehensive data management systems to industry leaders that span all asset classes and facets of finance. We focus on delivering high-quality solutions that are cost-effective and easy to use - empowering users to build queries and analyze data efficiently.

Our comprehensive suite of enterprise-wide tick data capture, storage and analysis solutions as well as reference and closing pricing data solutions address financial institutions’ need to capture, archive and retrieve tick data as well as perform analytics on streaming, real-time or archived data.\

Apache Qpid

Apache Qpid™ is a cross-platform Enterprise Messaging system which implements the Advanced Message Queuing Protocol (AMQP), providing message brokers written in C++ and Java, along with clients for C++, Java JMS, .Net, Python, and Ruby.

Rai Technology

Rai Technology builds innovative products for managing, distributing, integrating and monitoring real-time financial market data. The Rai platform’s’ modular integration architecture is what sets us apart. New data sources can be dynamically added and reconfigured to rapidly meet new requirements. Rai transport and payload bridges add OpenMAMA support to the integration services provided by Rai.

Redline Trading Solutions

Redline’s InRush 3 embedded ticker plant is used by leading banks, trading firms, and exchanges to received normalized market data for global equities, options, futures and foreign exchange. InRush achieves ultra-low latency performance, as measured by our published STAC-T1 benchmark, on a single mainstream server. The Redline OpenMAMA bridge enables OpenMAMA-based trading applications to receive InRush market data without having to rewrite these applications to the InRush API.